I Have A Tax Lien?

That unsecured property tax can bite you if you forget to pay the dang thing

By Heidi Walters[

{

"name": "Top Stories Video Pair",

"insertPoint": "7",

"component": "17087298",

"parentWrapperClass": "fdn-ads-inline-content-block",

"requiredCountToDisplay": "1"

}

]

The woman on the phone at first was certain it was a mistake.

"I have one of those? I have a tax lien?" said Denise Goforth, owner of the Petrolia General Store, Tuesday morning.

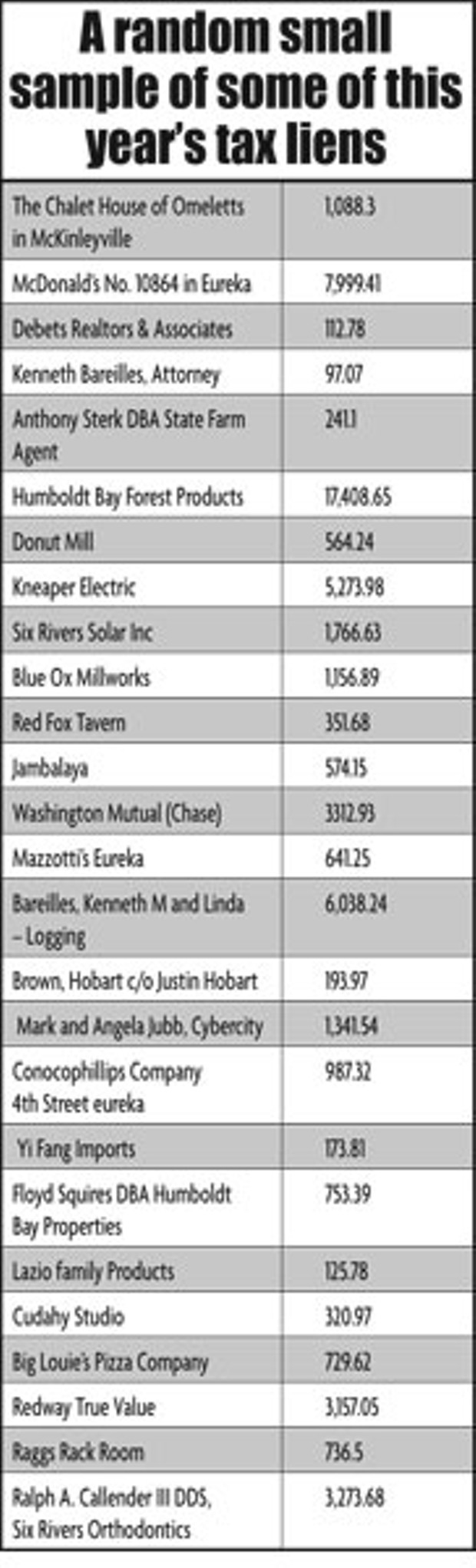

"Yep. It was recorded at the county clerk's office last week." And she wasn't the only one, I told her. Seven hundred Humboldt County residents -- including some more prominent folks -- had failed to pay their unsecured property taxes by the deadline, Aug. 31. Some owed less than $100; others owed several thousand.

Goforth, who owns a small business in Humboldt County, didn't remember getting a notice in the mail that she owed $772.35 in unsecured property taxes for the tax year that ended June 30, and that there'd be a lien placed on her if she failed to pay by Aug. 31.

"I'm a person who pays my taxes," she said, sounding perplexed and annoyed. She said she was going to call the county to see what it was about.

Moments later, she called back.

"Well," she said, "it's one I forgot. It's on the standing equipment, and I missed the deadline. We have walk-ins -- walk-in refrigerators and coolers -- and every year you have to pay an equipment tax on that. And I just had three deaths in the family, and I've been flying back and forth for illnesses and I just missed this one. [The notice] is probably in a box somewhere. And if I don't pay it by Dec. 31, on Jan. 1 they can take it out of my bank account."

Humboldt County Treasurer-Tax Collector Stephen Strawn says the unsecured property tax does sometimes take a few people by surprise, although most people pay it on time. Unsecured property taxes are levied on things not secured to land -- boats, airplanes, business equipment on leased or rented property, etc. They're also levied on property that is taxed as "possessory interest" -- anything taxable that is located on a government entity. For instance, if you rent a boat slip out at Woodley Island, you're using a public space that's now unavailable for use by others. That puts a taxable value on it. An airplane hangar is another example.

After June 30, the county mailed out about 7,500 unsecured property tax bills, representing an unsecured tax roll of $5.1 million, said Strawn. Most people paid on time, by Aug. 31. The ones who didn't received notices that they'd have a lien placed on them if they didn't pay. In the end, the county filed about 700 liens -- similar to last year, in which 675 liens were filed. This year's liens amount to about $390,000 in unpaid taxes, Strawn said. And many of these unsecured properties with liens on them, in Humboldt anyway, are boats -- hundreds of them, Strawn estimates.

In a handful of cases, a tax bill gets issued erroneously -- say, because a person moved to another state, taking their boat with them, but failed to notify the assessor's office. "And many times it is people that have sold the boat or disposed of it in some way and have not notified the assessor," Strawn said. "And they feel that ignoring the bill is the best way to solve it, and they don't find out until some later time that they've caused themselves some greater difficulty. "

But of course there are other reasons for not paying on time, including, for some, the economic downturn.

Once a lien is filed, the county send out another notice. The lien is good for 10 years. And the penalties can rack up. There's a 10 percent penalty for paying the bill late, plus some other fees. And then there's a one-and-a-half percent per month penalty on the amount owed -- 18 percent a year. "So you can see that within five years they will have more than doubled the amount that they owe," Strawn said.

Also, the county can indeed seize the delinquent amount owed from your bank account after the first of the year. "Last year we seized about 20 bank accounts," Strawn said. "And once someone's bank account is seized, the banks quite often have a substantial charge that makes it even more difficult for people."

The county can also seize the property itself. But because most of the tax-delinquent unsecured properties are boats, the county tends not to go that route.

"For one thing, for a practical matter, we have no place to store these boats if we were to seize them," Strawn said.

But probably the worst fallout from an unpaid tax bill is your battered credit, which can mess you up when you try to refinance a home or buy property.

"The lesson for people is two-part," said Strawn. "The first lesson is, if they receive a tax bill that they don't understand, they should contact the assessor's office or the tax collector's office and ask questions. And secondly, they should realize that there is a responsibility for a property tax bill that they receive, so it cannot be ignored."

Another business owner who was surprised he had a lien -- Darrell "Raggs" Evenson, owner of Raggs Rack Room in Eureka -- at first couldn't figure it out when reached by phone Tuesday. Then he said, "Oh, I know what it is. It's the yearly thing they send me for the [pool] tables. Obviously it's been overlooked. I'm very surprised that it doesn't happen more often with all the mail that a small business is bombarded with."

He said of course he was going to pay it, as did Goforth, the woman who owes taxes on her refrigerators in Petrolia. Although, she said, she thinks it's "a ridiculous tax."

"But, yeah, this one was my bad," she said. "I had no idea and I missed it. So, thanks for your unpleasant call."

Goforth said she planned to pay the late tax in person this Thursday when she went to Eureka.

Comments

Showing 1-1 of 1

more from the author

-

From the Journal Archives: When the Waters Rose in 1964

- Dec 26, 2019

-

Bigfoot Gets Real

- Feb 20, 2015

-

Lincoln's Hearse

- Feb 19, 2015

- More »

Latest in News

Readers also liked…

-

Through Mark Larson's Lens

A local photographer's favorite images of 2022 in Humboldt

- Jan 5, 2023

-

'To Celebrate Our Sovereignty'

Yurok Tribe to host gathering honoring 'ultimate river warrior' on the anniversary of the U.S. Supreme Court ruling that changed everything

- Jun 8, 2023