|

IN THE NEWS | CALENDAR

by JIM HIGHT

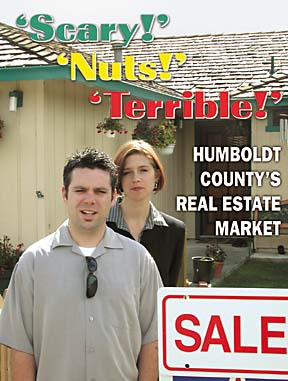

JEFF CROSS, 34, AND SEQUOYA ANDERHOLM, 27 [in above photo] recently began trying to buy their first house in Eureka, where they both grew up. With their combined salaries -- he's head clerk at a supermarket and she's an advertising executive -- they figured they'd be able to afford a three-bedroom house in one of Eureka's safer neighborhoods. But Cross and Anderholm quickly learned how expensive and difficult it is to buy a home in Humboldt County today. "The market is really over-priced," said Anderholm, standing with Cross and their 6-year-old son Cain outside a plain 1950s three-bedroom house listed for $170,000. "It's inflated beyond belief," agreed Cross. "It's amazing how quickly they go," said Anderholm. "Some sell within a week, and some sell the day they go on the market." A price spike "Amazing" is something a lot of people are saying about Humboldt County's real estate market. Other descriptions include "nuts," "terrible," "scary," "crazy," and "mind-blowing." For most of the 1990s, home prices in Humboldt County poked along at a slow pace, with an average annual increase in the median price of about 2 percent. The median-priced house that sold for $110,000 in 1992 had appreciated to $129,000 by 2000, according to data from the Humboldt County Association of Realtors. (Median is the price in the middle, where half the homes sold for more and half for less.) But in 2001, housing values rose 8.5 percent. And in just the first nine months of 2002, the median price of houses sold has shot up another 16 percent to $162,300. House prices have increased even more in some parts of the county. The North Bay region that includes Arcata, McKinleyville and Trinidad has seen median home prices go up to $180,000, according to the Realtors' association data.  "It's terrible news for local people," said Sue Forbes, [photo at left] a broker and owner of Forbes Associates in McKinleyville. "If you're not already in a home right now and riding that wave of appreciation, it makes it very difficult [to buy a house]. "It's terrible news for local people," said Sue Forbes, [photo at left] a broker and owner of Forbes Associates in McKinleyville. "If you're not already in a home right now and riding that wave of appreciation, it makes it very difficult [to buy a house].

"We don't have the jobs or the industry or the income [levels] here for somebody who's just starting out to buy a $180,000 house," said Forbes. As recently as 1998, buyers in Arcata could purchase a modest three-bedroom tract house -- most likely one built in the 1950s by the Pierson or Stromberg families -- for $100,000 to $115,000. Today, those homes are listed for $175,000 to $200,000. In Fortuna and much of the Eel River Valley, homes listed for under $200,000 are rare. "If I could find a house for $160,000, I'd sell it in a day," said Debi August, a Realtor and Fortuna City Council member. "I've been a real estate agent and broker for 30 years, and I've never seen anything like this happen here. I've never seen a house increase in value $55,000 in four months. "It's kind of scary," she added. "I worry about the young people getting married and looking for their first house." In Southern Humboldt, Realtor Vern Bonham says the least expensive house to sell recently in the Garberville and Redway area went for $295,000. "We have a house [in Redway] listed for $750,000," he said. "We've got another couple houses listed for $450,000 and we [recently] sold one for $410,000. "Three or four years ago if you'd [mentioned] these prices, somebody would have run you out of town," said Bonham. The Bay Area effect "I had a doctor buy a homestead in Mattole River. He paid $600,000 for that old homestead, flat cash, thank you very much," said Bonham. "I thought the price should have been probably $385,000. Sometimes you just shut up. "In the past the market was driven by the amount of dope that was grown," said Bonham. "Now it's just people out of the city who sold a home down there for $700,000 to $800,000." Realtors in other parts of the county echo Bonham's assessment. New residents are moving into the county with lots of cash to buy a home -- and driving values way, way up. "People from the Bay Area are selling their homes then coming up here and buying a house for cash and living without any house payments," said one Realtor. Some real estate agents trace the increased migration to the Sept. 11, 2001, terrorist attacks, when many city dwellers found a new motivation to move away from populous areas. Others see an ongoing trend that has accelerated. "We've seen a lot of people coming in from outside the area for the last four or five years, but we've really seen a lot of it since last year at this time," said Forbes. "People seem to be accelerating their retirement plans. [Some are moving here] to go back to school." Another trend driving the market is a new surge in real estate investing in the wake of collapsing stock values. "[Investors] think real estate is a better investment now than the stock market," said John Fessler, a loan officer with Prime Rate Mortgage in Arcata. "That really pushes prices and puts pressure on the young couple or other entry-level buyers trying to purchase a house for their own personal residence." Still cheap for California Even after the appreciation of the last two years, Humboldt County real estate still looks like a bargain to investors and newcomers who've owned property elsewhere. "One of my clients from San Francisco bought a house here sight unseen," said one Realtor. "`Where else can you find real estate that cheap?' she said." "In Humboldt County, we haven't seen the spectacular appreciation as in the Bay Area, Central Coast, Southern California and San Diego," said Fessler. "In the Bay Area, a 1,100-square-foot bungalow [might sell for] $750,000." But the fact that local housing values are still less than in the Bay Area and most of California -- the statewide median price is about $325,000 -- is little comfort to local people who are watching the cost of a Humboldt County house escalate beyond their grasp, perhaps permanently. Ironically, the current low interest rates for mortgages could make home ownership more affordable for first-time home buyers. But the rise in home prices has far outpaced the potential savings offered by declining interest rates. Consider the gap between the home-buying power of a family earning the median household income -- $31,226 -- and the median home price -- $162,000. With a 5 percent ($8,100) down payment and a 30-year mortgage at 6 percent interest, the monthly payments for a $162,000 home (with taxes and insurance) would be about $1,250, according to Fessler. To qualify for such a mortgage, a family with moderate debt (car payments, credit card balances, etc.) would need to earn about $46,000 per year. A seller's market Not only are homes more expensive, they're also harder to find. Between the newcomers, the investors, renters trying to buy their first house and homeowners looking to move up to a larger one, there is an enormous demand for homes in Humboldt County. But there are not a lot of homes available for sale. Real estate agents have more buyers than homes available, according to many sources. "The supply of homes on the market is the lowest I've seen," said Bob Lawton, a broker and owner of Humboldt Mortgage Company. With demand exceeding supply, competition among buyers has become intense. "Good houses sell within hours or days of going on the market," said one real estate agent. "Sellers are choosing from a range of offers, many of which come in above the asking price. "Buyers who have lost out on two or three houses in a row become more desperate," she continued. "They jump at the next opportunity. In some cases, people are offering $10,000 to $20,000 more than the asking price." With strong demand, high prices and short supply, the laws of economics should be leading developers to construct a lot more housing. That doesn't seem to be happening. The number of annual housing starts -- measured by building permits issued for new single-family homes -- has been on a downward trend since 1990, according to county records. In the late 1980s and early 1990s, housing starts averaged 380 per year. From 1994 through 2001, the annual average was 250. (This doesn't include the seven incorporated cities -- Arcata, Blue Lake, Eureka, Ferndale, Fortuna, Rio Dell and Trinidad; but it does include McKinleyville, Cutten and other fast-growing areas.) County figures for the first eight months of 2002 show that housing starts for this year will probably come to about 250. "We haven't seen a whole lot of new subdivisions coming into our office despite the fact that housing prices have gone up," said Michael Richardson, senior planner for Humboldt County Community Development Services. Buildable land scarce Why the market demand isn't leading to a greater supply of housing is a central question that county planners will explore in the next year as they update the county housing plan, known as the "housing element." One likely answer goes to the heart of what defines Humboldt County -- an abundance of natural-resource and agricultural lands. Developers say that between protected wetlands, nature preserves, and land zoned for agriculture or timber production, there is very little land available for new homes. As a result, land prices have soared. North Coast Home Builders, an association of developers, advocates rezoning more agricultural land for development. This would not only allow more housing to be built, it would also ease the price increases, they say.  "The first cost of building is the raw land," said Bob Higgons, director of the group. [photo at right] "If that remains in limited or short supply, its cost goes up. If no more agricultural land is going to be considered for residential use, the trade-off is higher cost for housing." "The first cost of building is the raw land," said Bob Higgons, director of the group. [photo at right] "If that remains in limited or short supply, its cost goes up. If no more agricultural land is going to be considered for residential use, the trade-off is higher cost for housing."

But many citizens oppose converting agricultural lands. Farms and pastures around North Coast towns are cherished by residents as open space "greenbelts." On top of the open space concerns, land conservation advocates -- including the Humboldt County Farm Bureau -- point to food security issues: as global population soars and farmland diminishes, every square yard of productive agricultural land becomes more important, they say. Some affordable-housing specialists, however, echo the builders' group's concerns about the short supply of land for building. "You want to preserve the character of the community and the greenspace, but on the other hand when you limit development options too much, then the cost [of land and new houses] goes up," said Kermit Thobaben, director of planning and programs for Redwood Community Action Agency, a Eureka nonprofit agency with several housing programs. "When elected officials make a decision [on the new general plan's zoning designations for agricultural land], they're going to have to weigh both sides of the issue," said Thobaben. But zoning more fields and farms for development may not help first-time home buyers. While land values may not increase as quickly, it's unlikely that more supply will bring current land values down. "Will we see a return to the $125,000 entry-level new home? I don't think so because the [current] cost of raw land will not allow it," said Higgons.  In addition to land, developers' other costs have increased sharply, particularly insurance to cover accidents and injuries during construction. "We're looking at costs of $5,000 to $10,000 [per house] just for insurance," said McKinleyville developer Mark Rynearson. [photo at left] In addition to land, developers' other costs have increased sharply, particularly insurance to cover accidents and injuries during construction. "We're looking at costs of $5,000 to $10,000 [per house] just for insurance," said McKinleyville developer Mark Rynearson. [photo at left]

Fees levied by local governments also drive up building costs, and so do conditions imposed upon builders, according to Rynearson and Higgons. For example, in McKinleyville builders of new subdivisions must set aside land for storm water retention basins because of water quality problems in local creeks. But the sales prices of new houses are also determined by the types and sizes of houses that are built. Developers build for the market, and except for first-time home buyers, most people in the market for a home in Humboldt County -- and elsewhere in California -- want a roomy house, 1,400 square feet and up, with "all the bells and whistles," as a recent ad for a new $269,000 home in Cutten proclaims. And they want the standard 60 x 100 lot -- if not a larger one. Thinking small To create more affordable new housing, advocates for first-time home buyers want county and city zoning codes changed to encourage developers to build smaller houses and denser subdivisions. "Land is so expensive that to create affordable homes we have to build more units on less land," said Kay Escarda, president of Humboldt Bay Housing Development Corp. (HBHDC), a non-profit organization. Escarda served on a county advisory group -- the Community Advisory Committee on the Housing Element -- that proposed several ideas for affordable housing in 1998, before it disbanded. Only one of its proposals was adopted by the county board of supervisors: allowing construction of second homes -- commonly called "mother-in-law" units -- on standard size lots. "That was a good step in the direction of getting affordable housing," said McKinleyville Realtor Forbes. With the county housing element being updated -- and the soaring cost of homes creating new urgency -- Escarda and others hope the county will take a second look at some of the group's other proposals. One idea is a "density bonus" that allows developers to build more houses per acre than current zoning allows if they ensure that a percentage of the homes will be priced affordably. Another is allowing developers to create some half-size lots in new subdivisions -- 3,000 square feet instead of the standard 6,000 -- with homes of 700 to 1,000 square feet instead of the usual 1,400 and up. "The idea is to create more rungs at the bottom of the ladder so young people can get access to the equity chain," said Dan Taranto, who also served on the advisory group. For the most part, these zoning changes would allow and encourage developers to build some smaller, cheaper homes. But mandatory policies are also under consideration. Arcata put an "inclusionary zoning" policy in its recently adopted general plan and it is now fine-tuning the details. "The city will set certain percentages of units that need to be affordable in the land use code update which is now underway," said Elizabeth Conner, director of HBHDC and an Arcata planning commissioner who supports inclusionary zoning. Without such policies, Conner says, "Arcata will continue to become a community where only higher-income people can afford to buy a home." The home builders group has spoken out against Arcata's inclusionary zoning policy, saying it will discourage developers from building anything in town. Conner, who's running for city council this fall, believes that the Arcata market is lucrative enough for developers to make a profit on a mix of upscale and affordable houses. "We can assist developers with incentives and trade-offs like density and setback bonuses to make sure it's financially workable for them, but we do need to require it," she said. On the voluntary measures, Higgons and Rynearson give mixed reviews. "There are some builders who would choose to go into the smaller-house market if a reasonable profit is there," said Higgons. But Rynearson fears getting stuck with houses nobody wants. "If I had 800-square-foot, three-bedroom, one-bath houses today, I could sell them. But in a normal market, I'd have trouble," he said. "The market here changes. It goes down just as rapidly as it goes up," said Rynearson. "This housing shortage has only come about in the last 24 months. Before that there were tons of houses [for sale] and [fewer buyers]." Rynearson also notes that "higher-density subdivisions are not real popular [with neighbors]. If I go next to your house [and propose] cutting down all the trees and building a high density subdivision are you going to be at the [planning commission] meeting?" Escarda acknowledges "there is sometimes resistance" to high-density subdivisions. "People in large houses on large properties don't want little ones next to them," she said. "People with a small home tend to keep it up just as well as owners of large homes," she said. "[But] sometimes the public doesn't understand that. It's something new." "If all you're offering in a community is expensive, big houses, then the people who could buy the smaller homes don't have any opportunities," she said. "Because of the market demand and the higher profits the developers make on expensive homes, the higher-priced homes will always be available. The need is to have something available for folks who can't afford the 2,500-square-foot homes." Condos coming? The dense-development approach favored by affordability advocates and the logic of the marketplace may work together to see a new type of housing come to the North Coast: condominiums. Buyers of condos -- both the attached "townhouse" style and the apartment style -- own their dwelling unit and a share of the common land and buildings in a development. Cheaper to build and easier to site in congested urban and suburban settings, condos have been popular for the last 30 years. But only a few condo buildings exist in Humboldt County. "People here like to have space and a garden and not be living with a common wall between themselves and their neighbor," said Forbes. But she and others think that may be changing. "As all of us baby-boomers get older, I think there is going to be a good market for [condos]," she said. "I think you'll find some of these being constructed. [They] allow you to have greater density than what you could have in a subdivision." "We're looking at building condos, for young people and seniors in particular," said Conner of HBHDC. "They might be mixed-income projects, with some low-income units and some market-rate units." Condo development could also dovetail with the "smartgrowth" approach to development advocated by many on the North Coast. Smartgrowth -- also known as "livable communities" -- aims to concentrate new development in already built town centers and neighborhoods, while preserving surrounding farm land. Smartgrowth also calls for a mix of uses -- housing, shops, services, employers -- so land is used efficiently, downtowns aren't abandoned at night and residents drive less.  "We would love to see condos built above commercial structures in the downtown, where we'd like to see mixed uses," said Larry Oetker, deputy director of redevelopment for Arcata. [photo at right] "We would love to see condos built above commercial structures in the downtown, where we'd like to see mixed uses," said Larry Oetker, deputy director of redevelopment for Arcata. [photo at right]

Downtown areas of Eureka and other North Coast towns might also be viable for condo development, according to several sources in the real estate business. An increase in condo development, however, might lead to renters being evicted as apartment owners decide to convert their buildings to condos. But city policies can limit this. Arcata's zoning code limits condo conversions to one building per year. (The limit applies only to existing apartment buildings, not to new condominium construction.) "We don't want to see a massive conversion of condos displacing renters," said Oetker. A bidding war While condos may appeal to singles and retired or childless couples, most families with kids are still looking for the detached house with a private yard. And for the time being, first-time home buyers like Cross and Anderholm can only shop from the small stock of older houses. In early September the couple made an offer on a $145,000 house. "It's a three-bedroom, very well maintained," said Anderholm. "It has style and charm and it's in an OK neighborhood. It's not our ideal home. We won't spend the rest of our lives in it. "We'll do some modifications," said Anderholm, who grew up in a family of building contractors. "And we'll probably sell when the prices jump again." But even though Anderholm and Cross made their offer the same day the house was listed, they were told the seller was waiting for more offers. "They got six offers in all, and they asked us all to resubmit bids [without regard for] the appraisal value," said Anderholm. At the Journal's deadline, they were preparing a modest counter-offer, but weren't very hopeful. "It's already high in our price range," said Anderholm. So it's back to searching for the elusive affordable house, a depressing prospect to the couple. "We've looked at several houses, and when we see stuff in our price range, we think, `How do people live in this?'" said Anderholm. "It's really hard not to be able to afford a house in the place where you grew up."

Building affordable homes

PROGRAMS RUN BY THE CITIES OF ARCATA AND EUREKA, THE U.S. Department of Agriculture, the Humboldt County Housing Authority and Redwood Community Action Agency have helped hundreds of first-time home buyers purchase a house in Humboldt County. But today's prices are out of reach for low-income buyers even with the programs' financial aid. And the seller's market puts subsidized buyers at a further disadvantage. "In our program, you cannot pay more for a house than the appraised value. That's a federal requirement," said Larry Oetker, deputy director of redevelopment for Arcata. "In this market, almost all Arcata homes sell for higher than their appraised value. That eliminates our first-time home buyers." New houses now being planned or constructed in Humboldt County won't help the situation because developers are building almost exclusively for people in the market for a $200,000-plus home. But three nonprofit agencies are working to build new homes within the price range of low-income first-time buyers. "Sweat equity" Two groups use the self-help approach that engages buyers in contributing labor and building "sweat equity" to make up for the cash they lack. Humboldt Habitat for Humanity, an affiliate of an international group based in Americus, Ga., has built six homes here. With a federal grant in hand, Humboldt Habitat has set a goal of building nine more homes within the next two years on a McKinleyville site. "To meet the pressing need, [Habitat is] going from [building] one house at a time to building an entire subdivision," said Jack Surmani, executive director. (See "Building a Village," Journal cover story Aug. 17, 2000.) In addition to the labor of home buyers, Habitat relies on donations of materials and services from local businesses, and the group is knocking on more doors to generate support for its expanded efforts. The other self-help housing program is jointly run by the local office of the agriculture department and Rural Communities Housing Development Corp., based in Ukiah. The two entities are nearing completion of a 10-home project on Thiel Street in McKinleyville and are preparing to break ground on another subdivision of 13 homes nearby. Buyers are required to work 40 hours a week for a year under the supervision of an on-site foreman. "It's like a full-time second job," said Kevin Jennings, construction manager. But family members can help out, with their hours counting toward the weekly requirement. "I couldn't afford to give my kids money, but I can give them my labor instead," said one man who was landscaping on a recent weekday evening. A land trust  The city of Arcata and Humboldt Bay Housing Development Corp. (HBHDC) -- a nonprofit that builds and manages apartments for low-income people -- are working together on a new approach to building affordable homes: a Community Land Trust. The city of Arcata and Humboldt Bay Housing Development Corp. (HBHDC) -- a nonprofit that builds and manages apartments for low-income people -- are working together on a new approach to building affordable homes: a Community Land Trust.

With a $351,000 loan from the city's redevelopment agency, HBHDC recently bought nine parcels in the subdivision known as Windsong off Janes Road in west Arcata. Using federal funds, it will build houses on the lots, then sell them for about $140,000 to people on the first-time home buyer program's waiting list. The city will chip in subsidies of up to $48,000 in low-interest loans and down payment grants, making a $140,000 home affordable to low-income people (To qualify, a family of three, for example, must have a yearly income below $28,200; a family of four must make less than $31,350.) But the land on which the houses are built will remain in the hands of the Community Land Trust. Buyers will sign a complex 99-year "ground lease" that lets them accrue some equity appreciation -- plus the value of home improvements they make -- but limits how much they can resell the home for. "When a buyer wants to sell, they can make a modest amount of money on the property, but they will not make a huge profit," said Oetker. "By land-trusting these houses that are built with public dollars, we protect the public's investment and make sure these homes stay affordable over the long term," said Elizabeth Conner, director of HBHDC. [in above photo, on the left] "They will remain as part of the affordable housing stock when they go on the market in the future." The organization intends to develop 13 more houses through the land trust within two years and would like to see the program go county-wide. "We need to work with cities and counties to put buildable land into the Community Land Trust now," said Kay Escarda, president of HBHDC's board of directors. [in above photo, on the right] The land trust will be a community-based organization with an elected board of directors. HBHDC is currently developing the legal structure for the trust and hopes to have it up and running by next summer. -- Jim Hight Jim Hight is a former Journal staff writer. He is also the husband of Elizabeth Conner, one of the sources quoted in this story.

IN THE NEWS | CALENDAR Comments? E-mail the Journal: [email protected]

© Copyright 2002, North Coast Journal, Inc. |